Annual Filing For LLP – Form 8

LLP Form 8 or Statement of Account & Solvency is a filing that must be filed every year by all Limited Liability Partnerships (LLPs) registered in India. Form 8 must be filed irrespective of turnover of the LLP with the Ministry of Corporate Affairs (MCA).

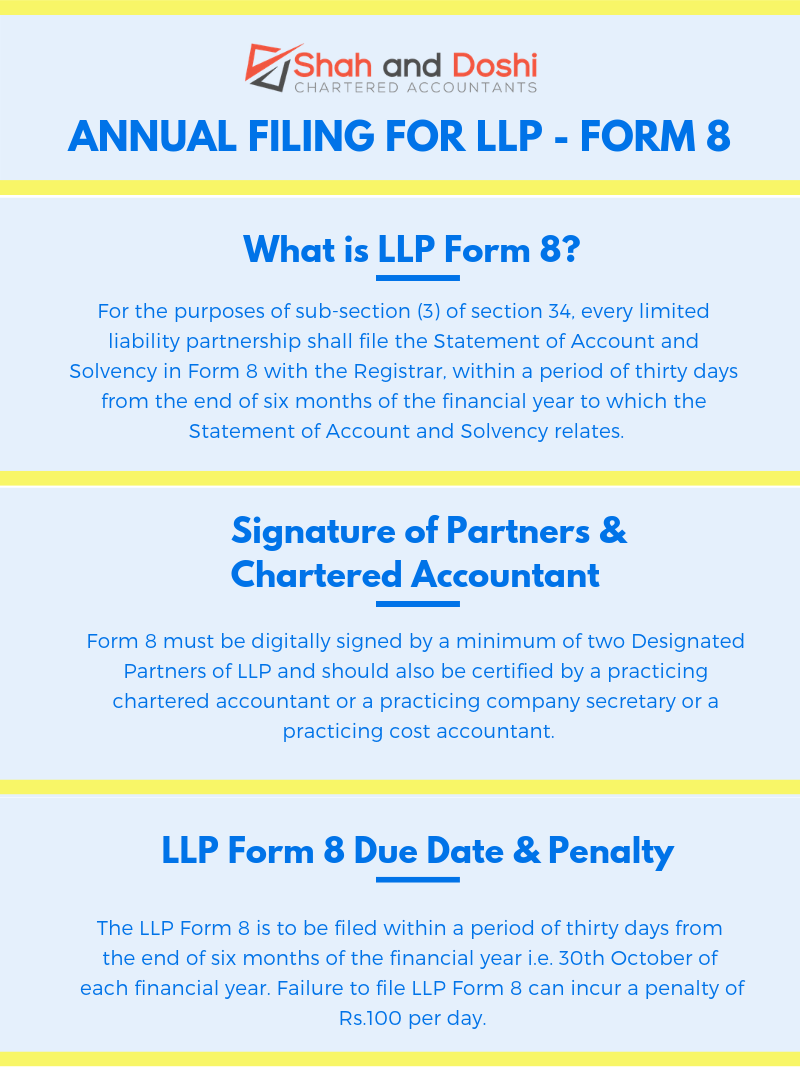

What is Form 8?

Form 8 is a declaration given by all the designated partners of LLP that whether they are able to pay its debts in full as they become due in the normal course of business or not. For the purposes of sub-section (3) of section 34, every limited liability partnership shall file the Statement of Account and Solvency in Form 8 with the Registrar, within a period of thirty days from the end of six months of the financial year to which the Statement of Account and Solvency relates.

Statement of Account & Solvency

Form 8 is also known as Statement of Account & Solvency. In Form 8, the LLP must provide details of financial transactions undertaken during the financial year and position at the end of the financial year. In addition to the financial position, the LLP must also:

- Declare that the turnover is above or below Rs. 40 lakhs.

- Declare that the LLP has already filed a statement indicating the creation of charges or modification or satisfaction till the present financial year.

- Declare that the partners/authorized representatives have taken proper care and responsibility for maintenance of adequate accounting records and preparation of accounts.

Contents of Form 8

Part A – Statement of Solvency

Part B – Statement of Accounts, Income and Expenditure

Attachments

The following documents must be attached with Form 8:

- Mandatory: Disclosure under Micro, Small and Medium Enterprises Development Act, 2006.

- In the case of contingent liabilities exists, Statement of contingent liabilities to be attached.

- Any other information can be provided as an optional attachment.

Signature of Partners & Chartered Accountant

Form 8 must be digitally signed by a minimum of two Designated Partners of LLP or Authorised Representatives of Foreign LLP. Further, if the total turnover of the LLP exceeds Rs. 40 lakhs or partner’s obligation of contribution exceeds Rs. 25 lakh, then Form 8 should be certified by the auditor of the LLP/ FLLP. Else, the digital signature of a minimum of two Designated Partners would suffice.

LLP Form 8 Due Date

The due date for filing LLP Form 8 is 30th October of each financial year. Failure to file LLP Form 8 can incur a penalty of Rs.100 per day. In addition to filing LLP Form 8, all LLPs must also file Annual Return in LLP Form 11 before 30th May of each financial year.

What is LLP Form 11?

Form- LLP 11 is Annual Return containing a number of partners, total contribution received by all partners, details of partners, detail of body corporates as the partner, summary of partners.

Every LLP would be required to file the annual return in Form 11 with ROC within 60 days of close of the financial year i.e. 31st March

Due Date of Filling of LLP Form 11 30th May for each year.

LLP Compliance

All LLPs registered in India must file the following forms each financial year, irrespective of business turnover or profits.

- LLP Form 11 Filing – Annual Return – Due on 30th May

- LLP Form 8 Filing – Statement of Account & Solvency – Due on 30th October

- ITR-5 – Income Tax Return for LLP – Due on 31st July if Tax Audit not required. Due on 30th September, if Tax Audit is required.

Sir

If the turnover is below Rs. 40L & contribution does not exceed Rs. 25L than why even after certified by one of the DP we need to provide details of auditor on page 5 of form 8