E-Form INC-22A – ACTIVE (Active Company Tagging Identities and Verification)

MCA has come up with another stringent move by inserting a new Rule 25A under the Companies (Incorporation) Rules, 2014 under which a new form has been introduced and made available on MCA portal i.e. e-Form INC-22A (ACTIVE)

- What is the applicability of Form INC-22A (ACTIVE)?

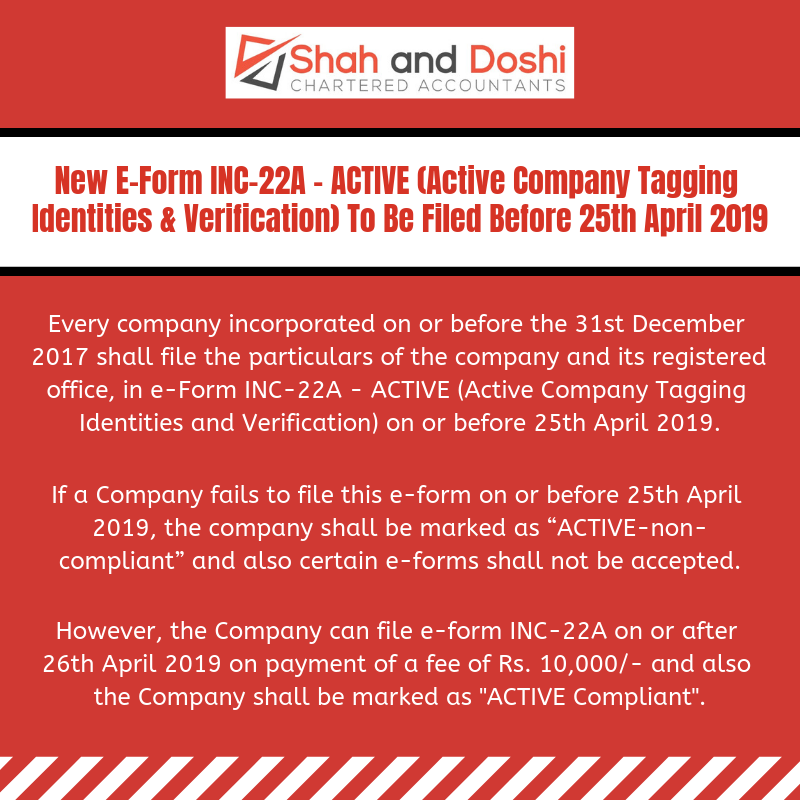

Every company incorporated on or before the 31st December 2017 shall file the particulars of the company and its registered office, in e-Form INC-22A-ACTIVE (Active Company Tagging Identities and Verification) on or before 25th April 2019.

However, any company which has not filed its due Financial Statements or due Annual Returns or both with the Registrar shall be restricted from filing e-Form INC-22A (ACTIVE), unless such company is under management dispute and the Registrar has recorded the same on the register.

- Which Companies are not required to file this Form INC-22A (ACTIVE)?

Following Companies shall not be required to file this e-form:

- Struck off companies

- Companies under the process of striking off

- Companies under liquidation

- Amalgamated or Dissolved companies

- What shall be the last date to file Form INC-22A (ACTIVE)?

Form INC-22A (ACTIVE) shall be filed on or before 25th April 2019.

- What sort of information is required to be furnished in Form INC-22A (ACTIVE)?

Information which is required to be furnished are:

- Company Details

- Name & Reg. Office

- Latitude & Longitude of the Registered Office of the Company

- Mail ID & OTP verification

- Of Directors with DIN

- Statutory & Cost Auditor Details

- Name, PAN

- Membership, Firm Registration Number (FRN)

- Period of appointment

- Key Managerial Personnel (KMP) Details

- SRN of e-form AOC-4 & MGT-7 for FY 2017-18

- Attachments to this Form

- Photograph of Registered Office showing external building

- Photograph of inside office also showing therein at least one director/KMP who has affixed his/her Digital Signature to this form.

- What if a Company fails to file Form INC-22A (ACTIVE) before the due date?

If a Company fails to file this e-form on or before 25th April 2019, the company shall be marked as “ACTIVE-non-compliant” and also the following e-forms shall not be accepted:

- SH-07 (Change in Authorized Capital)

- PAS-03 (Change in Paid-up Capital)

- DIR-12 (Changes in Director except for cessation)

- INC-22 (Change in Registered Office)

- INC-28 (Amalgamation, de-merger)

- Can a Company file this e-form INC-22A (ACTIVE) after its due date?

Yes, In case a company does not file e-Form INC-22A (ACTIVE) within the time limit, it can file e-form on or after 26th April 2019 i.e. after the due date on payment of a fee of Rs. 10,000/- and also the company shall be marked as “ACTIVE Compliant”.

These rules shall come into force with effect from 25th February 2019.

hi

is a Limited Liability partnership LLP Firm required to file INC 22A.

or are they exempted