Check Your HSN, SAC & State Codes Under The GST Model Law

HSN stands for Harmonized system of Nomenclature, it is an internationally accepted product coding system used for maintaining the uniformity in the classification of goods.

Goods traded across the world are known by different names due to language differences. Similarly, in IT-enabled multinational trade, a unique code is given to each class of tradable commodity based on its nature and usage. This process of classification and codification is known as the HSN Code that will be required for the filing of GST.

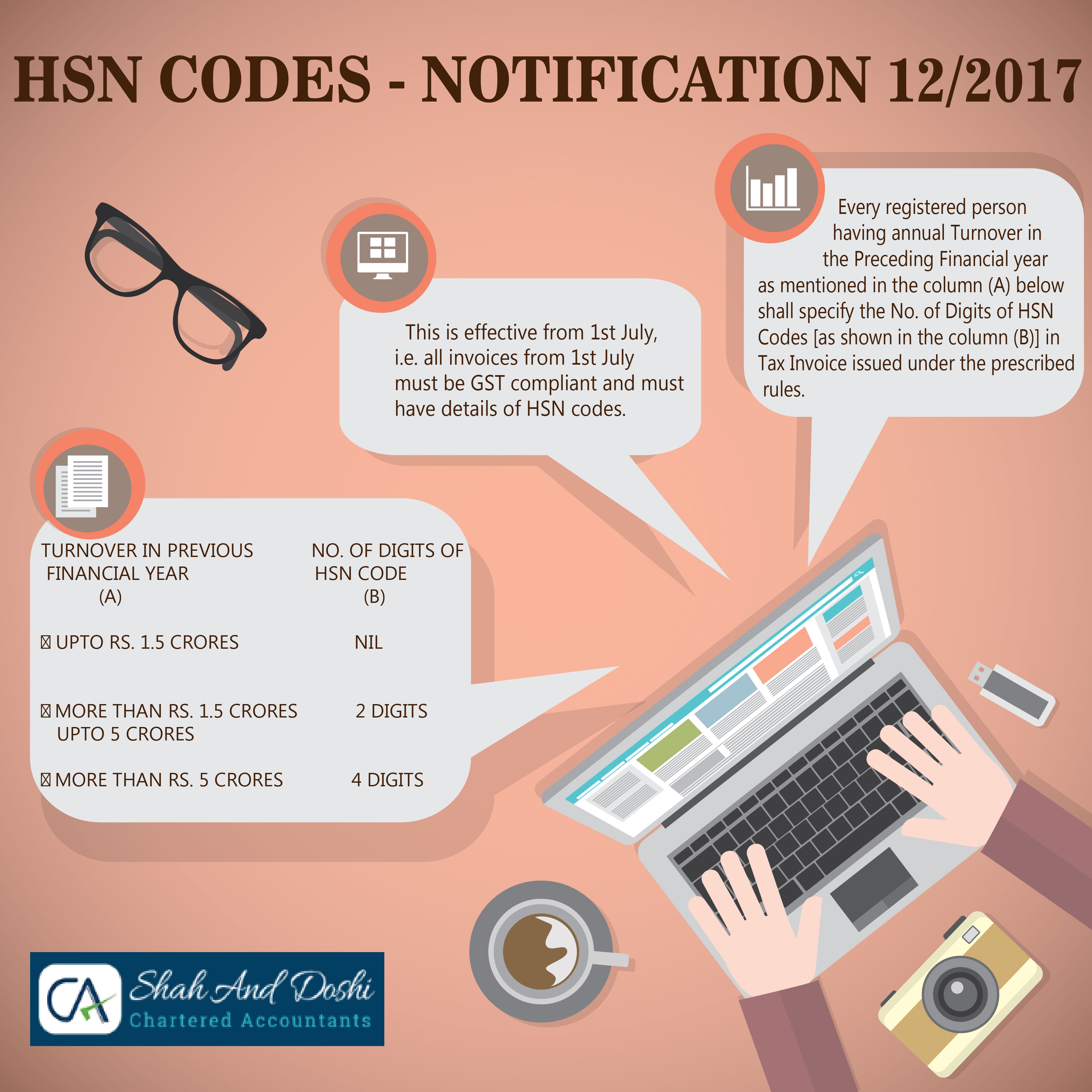

Under the GST regime, a majority of dealers will have to adopt Two-, Four-, or eight-digit HSN codes for their commodities or goods, depending on the turnover of the previous year:

- Businesses with a turnover of less than Rs 1.5 crores will not be required to use HSN codes for their commodities.

- Businesses with a turnover of Rs 1.5 crores and Rs 5 crores shall be required to use two-digit HSN codes for their commodities.

- Businesses with turnover equal to Rs 5 crores and above shall be required to use four-digit HSN codes for their commodities.

- In the case of imports/exports, HSN codes of eight digits shall be compulsory, as GST has to be compatible with global standards.

TO CHECK HSN CODE FOR YOUR BUSINESS PLEASE CLICK HERE

Services are classified as per the Services Accounting Code (SAC) adopted by the Central Board of Excise & Customs (CBEC). This is expected to remain the same in the GST regime as well.

FOR THE LIST OF EXISTING SERVICE ACCOUNTING CODES (SAC) REQUIRED FOR THE IDENTIFICATION OF SERVICES, PLEASE CLICK HERE

The TIN (Tax Payer’s Identification Number) consists of total 11 digits, the first two-digit of TIN is represented by the mentioned state code in the list.

TO KNOW YOUR STATE CODE PLEASE CLICK HERE