E-Form DPT-3 – Return of Deposits

Introduction

Every Company other than a Government Company shall file a one-time return of outstanding receipt of money or loan by a company but not considered as deposits, from 1st April, 2014 to the date of publication of this notification (i.e. 22nd January, 2019) in the Official Gazette, in e-form DPT-3 within 90 days from the date of publication along with fees as provided in the Companies (Registration Offices and Fees) Rules, 2014.

Applicability of Return of Deposits

- Form DPT-3 filing must be made by all companies other than a Government company. Hence, all Private Limited Company, OPC, limited company or Section 8 Company would be required to file Form DPT-3 after the publication of these rules.

- DPT-3 is required for filing for both Secured and Unsecured Loan and advance for goods and services.

- The form DPT-3 is supposed to file for all kinds of loan received by Company. Hence, in case a Company has received a loan from a Holding or Subsidiary Company or Associate company, it has to file e-form DPT-3.

- The e-form DPT-3 is to be filed for outstanding loans of a company. Hence, if a loan was due before as on 1st April 2014, and is still outstanding in Company’s record, it has to be reported to ROC in e-form DPT-3.

DPT-3 Due Date

The Companies (Acceptance of Deposits) Amendment Rules, 2019 has mentioned that all companies other than the Government Companies would be required to file Form DPT-3 one-time on or before the 22nd of April 2019. In the return, the company must provide details of outstanding receipt of money or loan by a company but not considered as deposits from 1st April 2014 up to 22nd January 2019.

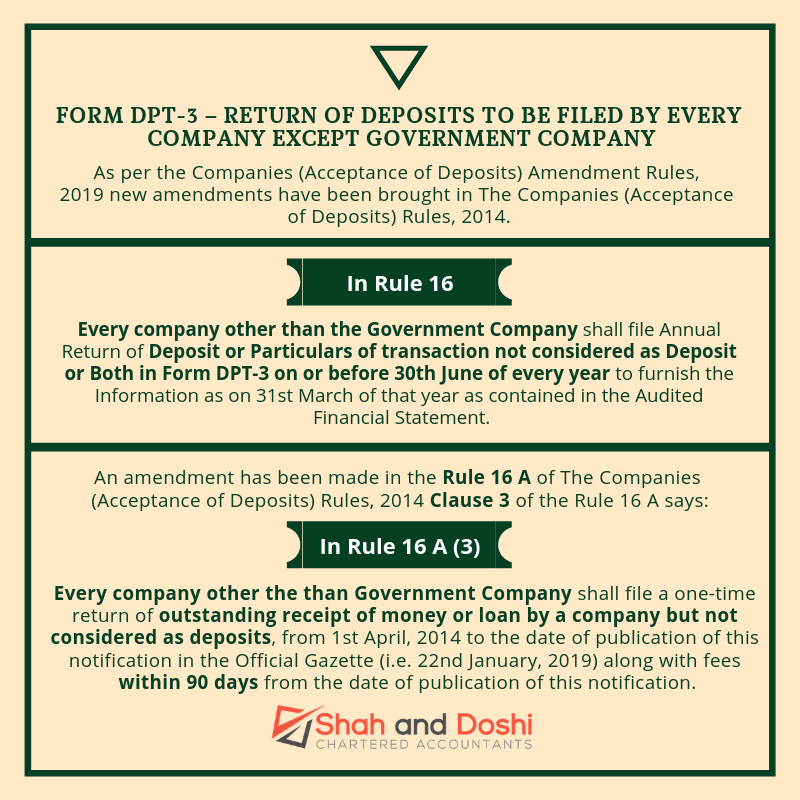

Introduction & Effect of Explanation of Rule 16 of Companies (Acceptance of deposits) Amendment Rules, 2019

Amendment Applicability of Rules Type of Returns Due Date

Explanation to rule 16 Every company other than the Government Company Shall file Annual Return of Deposit or Particulars of transaction not considered as Deposit or Both, to furnish the Information as on 31st March of that year as contained in the Audited Financial Statement. On or before 30th June of every year

Introduction to rule 16 A (3) Every company other than Government Company shall file a one-time return of outstanding receipt of money or loan by a company but not considered as deposits, from 1st April, 2014 to the date of publication of this notification in the Official Gazette (i.e. 22nd January, 2019) along with fees Within 90 days from the date of publication of this notification.

Non-applicability of Return of Deposits

- Since all Companies other than the Government Companies shall have to file e-form DPT-3 for outstanding receipt of money or loan by a company not considered as deposits, hence there is no need to file e-form DPT-3 if there is no outstanding loan as on 22nd January 2019.

- If a Company has already repaid its Loans before or on 22nd January 2019, then such loan is no longer outstanding in Company’s records. Hence, no need to file e-form DPT-3.

- If there is no outstanding loan or the company does not accept any loan there is no need to file e-form DPT-3 with ROC.