Important Due Dates To Remember For The Month Of July & August!

The decision of the GST Committee to allow transitional credit towards discharging tax liabilities of July, the extension of due dates for tax payment & filing of GSTR-3B by 25th August has provided much-needed relief to traders & businesses.

GSTR-3B has been extended for the month from July to December 2017.

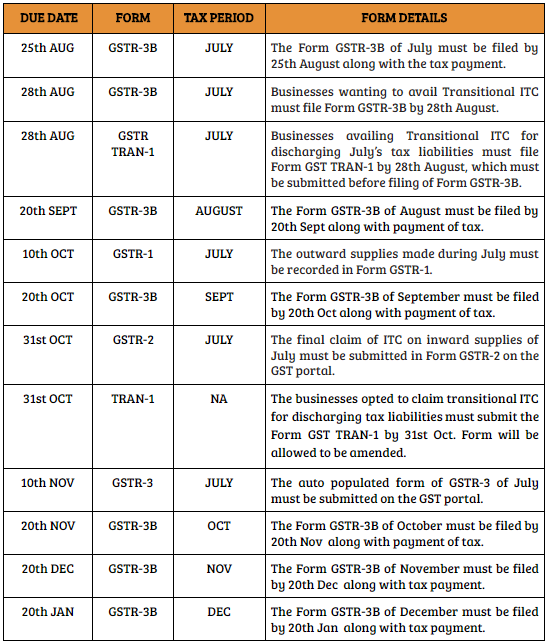

To help you prepare better we are listing down the important dates for GST returns for the month of August and September 2017.

With due dates being revised & extended, businesses will have to re-align the compliance activities in accordance with the changes.

Businesses must closely track the due dates & ensure that relevant forms are filed within the mentioned date because non-adherence of GST laws will eventually have a tremendous impact on the credit rating.

NOTE:

GSTR-3B must be filed & submitted by Every Registered Dealer even if there are no transactions during the month of July & August.

However, the following registrants do not have to file GSTR 3B:

1. Dealers under Composition scheme

2. Input Service Distributors

3. Non-Resident Taxable person

4. E-Commerce Operators